Practical Cash Stuffing Tips for Everyday Budgeting Success

Cash stuffing is a widely used budgeting technique where you divide your income into various physical envelopes, with each one assigned to a particular expense category. As a result, it helps limit overspending and increases savings discipline. With inflation concerns rising, people are adopting this method for daily budgeting.

According to data, 51% of U.S. adults expect inflation to rise in 2025. Consequently, many are searching for more controlled and visual ways to manage their money. Unlike digital tools, this saving method creates a tangible awareness of where each dollar goes. Therefore, it’s proving effective for those seeking stability in a shifting economy.

Key Takeaways

- Envelope budgeting sets specific boundaries for every spending category.

- Combine daily and monthly methods for flexible budgeting.

What Is Cash Stuffing and Why It Works

Envelopes for Cash Stuffing | Image Source: mayaonmoney.co.za

Cash stuffing envelopes method, was popularized by finance experts like Dave Ramsey and has recently regained popularity through platforms like TikTok. The concept is simple: allocate cash into different envelopes labeled by category and only spend what’s in each envelope.

This strategy helps avoid overspending because it sets a physical limit on each expense. Unlike swiping a card, handing over cash feels more “real,” which creates a natural sense of caution. Studies have shown that people spend less when using cash compared to credit or debit cards.

Moreover, the visual nature of this method builds better awareness and accountability. By seeing the money deplete in real time, you’re more likely to pause and reconsider non-essential purchases. As a result, the process encourages mindful spending as an essential step toward long-term financial health.

How to Start Cash Stuffing

Starting cash stuffing might seem intimidating at first, but the process is quite straightforward. Here’s how to do it.

1. Determine Your Income

Start by calculating your total take-home pay for the week or month. This includes all income after taxes and deductions. Knowing your exact budget limit sets the foundation for your plan. Without this step, it’s hard to allocate cash properly.

Also Read : The Best Laptop for Graphic Design: 7 Powerful Picks for Creatives

2. List Your Expenses

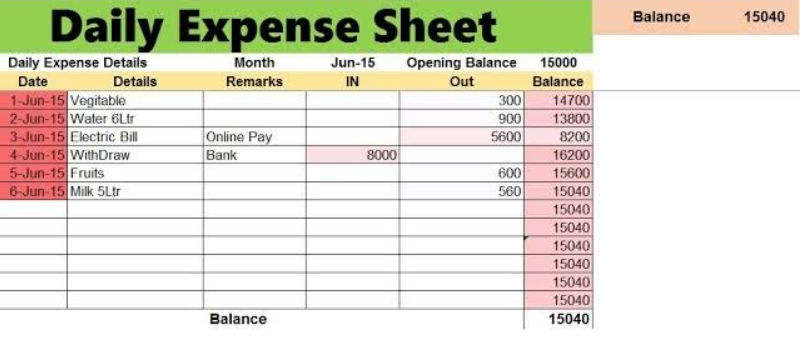

Daily Expenses | Image Source: ms.codes/blogs

Write down every expense you expect to cover, both fixed (like rent) and variable (like food or gas). This helps you see where your money goes each month. Be as detailed and realistic as possible. Accurate planning prevents surprise shortfalls.

Also Read : 15+ Must-Know AI Art Styles for Content Creators

3. Create Categories

Now group your expenses into categories such as groceries, bills, transportation, or fun. These should reflect your real spending habits. Clear categories make envelope labeling easier. As a result, you’ll have better control over each spending area.

4. Allocate Your Cash

Withdraw the total amount of money you plan to use for the budgeted period. Then, divide it into your labeled envelopes based on the set categories. This step turns your plan into action. Use only what’s inside each envelope.

Also Read : What Are Meme Coins and Why Are They So Popular?

5. Track Spending

Keep an eye on how much money you take from each envelope. Avoid borrowing from one envelope to cover another category. Tracking keeps you accountable and builds discipline. Over time, this habit strengthens your financial awareness.

Also Read : Alert! How Has AI Been Affecting UX Design and Designers

How to Choose the Right Envelopes and Budgeting Tools

To make cash stuffing for beginners work smoothly, it’s important to choose the right tools from the start. While basic paper envelopes are useful, many prefer durable options. Therefore, items like zipper wallets or binders are gaining popularity. These alternatives offer better structure and help keep everything in one place.

In addition, some people choose colorful pouches or labeled sleeves to make budgeting more engaging. Not only do they look appealing, but they also encourage consistent use. As a result, using tools that suit your style can boost motivation. Over time, this builds stronger budgeting habits that are easier to maintain.

Next, make sure each envelope is clearly labeled with its spending category and limit. You can also add a small tracker to record each transaction for better visibility. Printable budget sheets or mobile apps can help support your physical system. This combination makes it easier to track and adjust your spending regularly.

What’s Better Between Daily vs. Monthly Cash Stuffing?

One great advantage of cash stuffing is its flexibility. Daily budgeting suits small, frequent expenses like coffee or transport. It helps you track spending closely and stay mindful. Therefore, it’s ideal for managing everyday costs effectively.

On the other hand, monthly planning works well for fixed bills. It helps you organize income ahead and avoid missed payments. Many combine both for better balance and control. Ultimately, the best method depends on your lifestyle and needs.

Make Every Dollar Count With Cash Stuffing Now!

In short, cash stuffing isn’t just a passing trend but a mindset shift. By physically organizing your money into clear categories, you create better habits. It helps improve discipline, track your progress, and manage spending intentionally. Especially in times of economic uncertainty, this low-tech approach keeps you financially grounded.To make your envelopes even more personalized and practical, consider using fonts for cash stuffing envelopes by Lettersiro. With a desktop license, you can use fonts for non-sale items limitless. For more beautiful fonts and commercial-ready options, head to our official website that’s trusted by creative budgeters worldwide.